Why do rich Norwegians pay a lower tax rate?

Personal Finance & Money Asked on April 1, 2021

In this article, the author claims

Norway’s richest one percent pay on average 22 percent in tax

and

the 0.1 percent pay only between 9 and 17 percent tax

Firstly, is this correct? And if so, how can this be? In this question about Warren Buffett’s tax rate being lower than his secretary’s, the lower rate is attributed to capital gains taxes versus income and payroll taxes. However, that theory still does not explain how Norwegian billionaires’ tax rates could get as low as 9 percent.

2 Answers

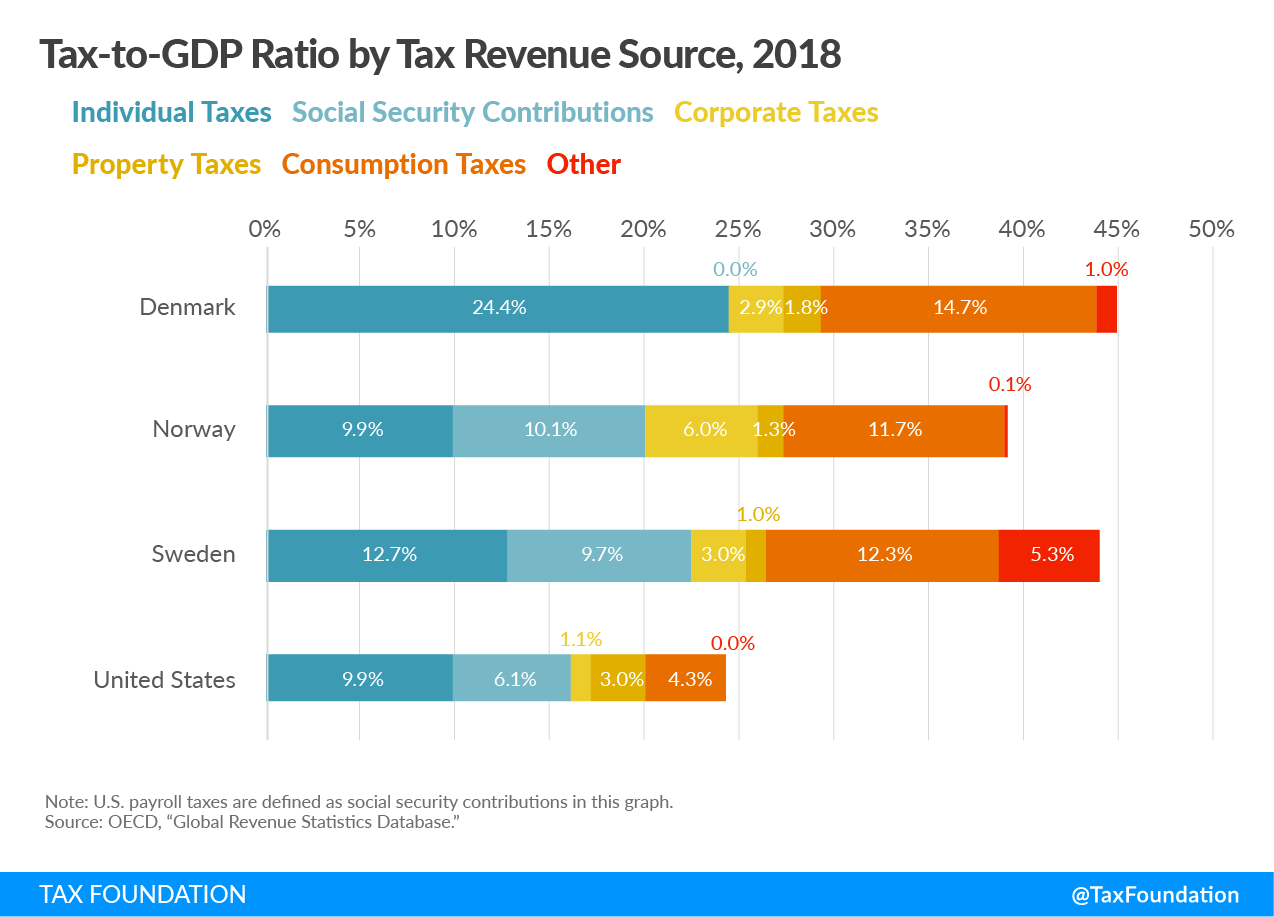

Countries vary in both the way they collect taxes and how much they collect.

As you can see here, Norway collects as much income tax as the US

I.e. not much, but collects the same again in social security contributions.

Such social security contributions are levied on the employed through payroll taxes. Such taxes only affect those who are employed, while the richest earn their wealth from business ownership.

So inherently as a rich person a system with relatively high payroll taxes is going to mean you tend to pay lower taxes than a comparably high tax (as % of GDP) country with low payroll taxes.

The Norwegian system has 22% income tax plus an additional surtax which is 16.2% over 1 million NOK

https://www.skatteetaten.no/en/rates/bracket-tax/

This is $110,000

So the rich nominally pay 38.2% marginal tax on the income over $110k or so.

However the very rich in Norway are no different from the rich anywhere else and will seek not to pay tax where it is not necessary. Because they are not salaried, they can hide their wealth inside companies

9% would represent the average tax paid by the rich based on some assessment of what they earned versus the actual tax liability, which may be much lower thanks to the use of tax planning.

The real explanation is here, and IMO the claim is false.

https://sciencenorway.no/economy-income-money/the-richest-norwegians-pay-the-least-taxes/1749237

If for example we compare a company that has $1m sales and $800k non-payroll expenses and $200k payroll inclusive of taxes, then that company pays no tax itself, because its profit is zero

However the $200k will be taxed when paid to the employees, in the Norwegian system perhaps totalling 39% for average workers.

If the company increased sales to $1.2m then the company has profit of $200,000. Previously if paid as a dividend this would have been taxed on the corporation (at 22%), but if it is paid as a dividend then the tax is instead paid by the individual, which as we've noted is 38.2% for the rich.

So as the article explains, the money is kept within the company, which they own, and is taxed there at 22%. The individual pays nothing personally, but the company they own does pay CT.

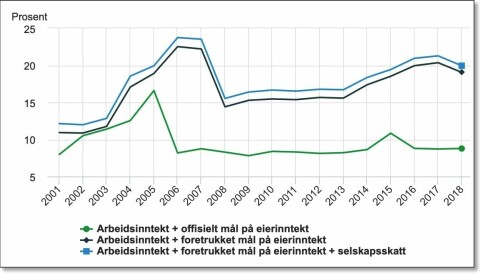

This graph shows this

The green line is declared income by the very richest, which fell after the tax system changed disincentivising dividends in 2006.

The other lines are the actual income on a comparable basis including corporate income of their owned companies

It does not seem to be true that the real rate is 9%, since the corporate tax rate is 22% - I believe they are choosing to count the increase in corporate capital owned by an individual as income, but ignore the corporate tax paid when doing so.

In fact it looks like the real tax rate is around 36% (which is the rate paid by the 99th percentile) blended with the 22% , which would be asymptotic at 22%. However it could be misleading to quote this figure in that all that retained corporate income is certainly real wealth and can be used as invested to create more wealth, but it still might be taxed in the future if it is ever realised as personal income. So we can't know the full taxation rate until the money eventually escapes - if the company makes $10m profit and pays $2.2m tax, then invests $7.8m in other shares then those shares could go to zero, in which case the money never reached its ultimate owner, or they could go to say $78m, where they might or might not be taxed at some point depending on things like death taxes and so on.

The issue is that large corporations such as Amazon generally pay low corporate tax rates in most successful jursidictions, so it's not obvious that a Norwegian company should be any different - they are effectively arguing that if say Apple makes a big profit, then Steve Jobs' widow should be taxed on that profit above the taxes already paid by Apple itself, even though it's possible that in the future Apple will blow that cash and she won't see a penny of it.

Rich people generally won't crystallise large incomes unless they can do so at a favourable tax rate, or they NEED to, for some purpose. Hence they don't pay much tax, but they also don't sit on a big pile of cash in the bank - that cash is owned by their company. Probably they still benefit from it in various ways, but that would depend on more minutiae of tax law, e.g. buying yachts etc. via the company

Correct answer by thelawnet on April 1, 2021

The broad answer is extremely simple, in certain countries they (very confusingly) re-name some taxes and then "don't refer to them as taxes."

This causes great confusion when comparing "the money the government takes away".

That's all there is to it.

Answered by Fattie on April 1, 2021

Add your own answers!

Ask a Question

Get help from others!

Recent Questions

- How can I transform graph image into a tikzpicture LaTeX code?

- How Do I Get The Ifruit App Off Of Gta 5 / Grand Theft Auto 5

- Iv’e designed a space elevator using a series of lasers. do you know anybody i could submit the designs too that could manufacture the concept and put it to use

- Need help finding a book. Female OP protagonist, magic

- Why is the WWF pending games (“Your turn”) area replaced w/ a column of “Bonus & Reward”gift boxes?

Recent Answers

- Peter Machado on Why fry rice before boiling?

- Joshua Engel on Why fry rice before boiling?

- Lex on Does Google Analytics track 404 page responses as valid page views?

- Jon Church on Why fry rice before boiling?

- haakon.io on Why fry rice before boiling?