Why are long-dated US treasury bond yields so low?

Personal Finance & Money Asked on February 28, 2021

I know that the US Fed sets only the federal funds rate, which impacts only the shorter term treasury bonds. The longer term bond yields (ie 20, 30 years) are impacted by demand for those bonds. The more people that want it, the lower the yield. Currently, the yields are extremely low (compared to historic values). Does this mean that many people are buying these bonds? I thought the QE/bond buying from the fed only related to shorter timeframes? Where is the demand, and thus the low yield, for the 30 year treasury bond coming from?

To provide some context, I am asking this in relation to the current US stock market performance. I believe we are in a bubble, but because interest rates are so low, there is essentially no alternative to US equities to avoid cash devaluation. Because of this, I expect the bubble to continue, until rates rise and provide a non-stock market alternative investment. I plan to continue to monitor the bond rates. But I am getting confused as to why the long term rates are so low? Who the heck is buying those long term bonds at the moment?

One Answer

In short, because the market prices them that way. There is still huge demand for (effectively) risk free long term bonds at these rates, for a number of reasons so large many books could be written about it. However, for the sake of a super of a super simple overview, here's two key points:

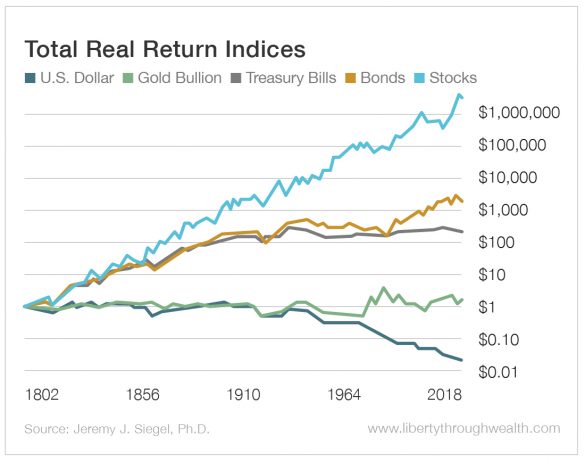

- Long term risk free/low risk debt has historically always had a terrible inflation adjusted return, it's just that inflation was also often very high so people got used to these nice round headline numbers of interest rates without fully pricing in inflation. Compare these asset classes total return since 1802 (particularly bonds and bills) for example:

- Because of this, worrying too much about them isn't worth much time because they have always been terrible investments over medium+ (and even most short) timescales vs more productive assets, and you shouldn't be holding much of them or worrying too much about what effect they have on stock or other markets unless your timescales are very short or your risk appetite is very low.

Correct answer by Philip on February 28, 2021

Add your own answers!

Ask a Question

Get help from others!

Recent Answers

- Lex on Does Google Analytics track 404 page responses as valid page views?

- haakon.io on Why fry rice before boiling?

- Jon Church on Why fry rice before boiling?

- Peter Machado on Why fry rice before boiling?

- Joshua Engel on Why fry rice before boiling?

Recent Questions

- How can I transform graph image into a tikzpicture LaTeX code?

- How Do I Get The Ifruit App Off Of Gta 5 / Grand Theft Auto 5

- Iv’e designed a space elevator using a series of lasers. do you know anybody i could submit the designs too that could manufacture the concept and put it to use

- Need help finding a book. Female OP protagonist, magic

- Why is the WWF pending games (“Your turn”) area replaced w/ a column of “Bonus & Reward”gift boxes?